- Strategy & Operations

- 4 min read

Godrej split: Board exits done, stake divestment to follow

The amicable separation is between two branches of the founding family with Adi Godrej and brother Nadir Godrej on one side and their cousins Jamshyd Godrej and Smita Godrej Crishna on the other. The latter two are brother and sister.

Mumbai: The Godrej family has begun the formal division of the conglomerate established more than a century ago by exiting the boards of each other’s companies and will soon divest stakes in them, said people with knowledge of the matter. Toward this end, Adi and Nadir Godrej resigned from the board of Godrej & Boyce earlier this year, while Jamshyd Godrej relinquished his seat on boards of GCPL and Godrej Properties.

The amicable separation is between two branches of the founding family with Adi Godrej and brother Nadir Godrej on one side and their cousins Jamshyd Godrej and Smita Godrej Crishna on the other. The latter two are brother and sister.

Top executives close to the matter said real estate estimated at Rs 3,400 crore, mostly prime land in the Mumbai suburbs, will remain under Godrej & Boyce (G&B), and a separate agreement will be worked out to govern ownership rights.

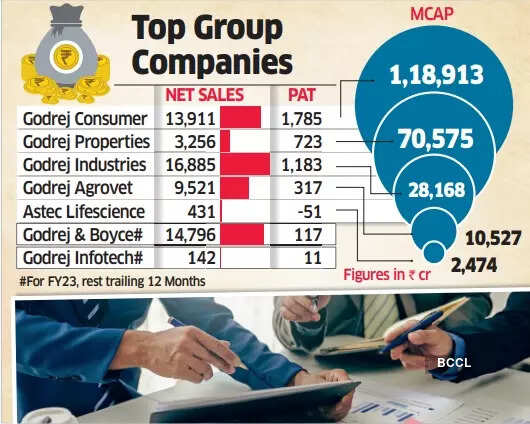

The Godrej Group comprises five listed companies — GCPL, Godrej Properties, Godrej Industries, Godrej Agrovet and Astec Lifesciences — valued collectively at Rs 2.34 lakh crore at close of markets on Thursday. The five listed firms reported nearly Rs 42,172 crore in revenue and Rs 4,065 crore in profit in FY23. G&B is a privately held company. The conglomerate operates diverse businesses including engineering, appliances, security solutions, agricultural products, real estate, and consumer products.

The Godrej Family Council is ironing out key specifics involving two critical points, said the people cited above. These include usage of the Godrej brand name after the split, including possible royalty payments, and the valuation of land held by G&B. The division has been in the making for about three years with the objective of establishing a clear delineation of ownership for future generations, said the people cited above.

Members of the Godrej family didn’t respond to queries.

The process is intended to lead to an uncomplicated ownership pattern and business structure to ensure better shareholder value, said the people cited above. While both sides owned shares in each other's businesses, there was no operational interference. Each side was a passive stakeholder. Family heads Adi and Jamshyd Godrej are 82 and 75, respectively.

“The entire process is being worked out in an amicable and well-thought out-process by both factions with the help of external professional advisors who have brought in the heft of their experience to the table,” said a highly placed executive close to the group. “It is a case study on how progressive business families function.”

Nimesh Kampani of JM Financial and Zia Mody of AZB & Partners are advising Jamshyd Godrej, while Uday Kotak and Cyril Shroff's legal firm Cyril Amarchand Mangaldas have led discussions from the Adi Godrej side.

Five family members — Adi Godrej, Nadir Godrej, Jamshyd Godrej, Smita Godrej Crishna and Rishad Godrej — hold 15.3% each in G&B, while the Pirojsha Godrej Foundation holds around 23%. Rishad Godrej is another cousin.

The privately held G&B is into appliances, construction, precision engineering, furniture retailing and aerospace, among other sectors. G&B reported revenue of Rs 14,796 crore in FY23, with a net profit of Rs 117 crore. The company had investments of Rs 8,596 crore and a cash of Rs 561 crore as of March 31, 2023. Additionally, the company holds a 7.33% stake in GCPL and a 3.83% stake in Godrej Properties, with a combined valuation of Rs 9,089 crore as of Friday.

GCPL is the biggest among the listed firms, with a market capitalisation of Rs 1.20 lakh crore as of Thursday. Godrej Industries holds a 23.74% stake in GCPL, while G&B and Godrej Seeds and Genetics own 7.33% and 27.42%, respectively. Godrej Seeds and Genetics is a privately held company with Tanya Arvind Dubash, Smita Godrej Crishna and Nisaba Godrej as directors.

Godrej Industries is a holding company with interests in consumer goods, agriculture, real estate, chemicals and financial services, and also acts as the incubator for new businesses. Apart from its stake in GCPL, it holds 64.88% in Godrej Agrovet and a 47.34% stake in Godrej Properties.

Godrej Industries' promoter holding is split among 28 family members. Rishad Naoroji owns 12.65%, and Jamshyd Godrej and Nyrika Holkar own 9.34% and 8.01%, respectively. The promoters have increased their stake in Godrej Industries by nearly 3% in the past three years. Shares of Godrej Properties and Godrej Industries have nearly doubled in the past year, while GCPL and Godrej Agrovet have gained 21% and 26%, respectively. The group was established by Ardeshir Godrej and Pirojsha Burjorji Godrej in 1897.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions